Table of Content

The latest housing stats for August already point to an increasing inventory amidst moderating demand. The rise in rates is having the Fed’s desired effect on housing, as house price growth began to slow in June. The group continues to anticipate a strong deceleration in home price growth going forward due to the lagged effects of higher mortgage rates and the slowing economy weighing on purchase demand. If you're interested in buying a home, a good bet is to keep tabs on your local housing market to track inventory -- and to also pay attention to how mortgage rates are trending. While you may fare well buying a home in the next few weeks, buying in the next few months could be your ticket to a lower purchase price and a less stressful house hunt on the whole.

For a quick and easy way to find RamseyTrusted agents in your area, try our free Endorsed Local Providers program. We only recommend agents who share our mission to serve you with excellence. Typically it’s winter because people aren’t usually looking to buy a house once cold weather and the holidays arrive. Less demand for homes will give you some bargaining power.

You’re our first priority.Every time.

This leads to high prices and stiff competition for home buyers. With the general shortage of housing options, some potential home buyers are forced to go above and beyond to obtain a home. There are still fewer homes on the market than buyers looking for properties, making it a seller’s market. But this year, the number of available homes will likely increase, making it easier for buyers to find the home they want. In reality, there’s never a perfect time to buy a house – it’s challenging any time, even when it’s a buyer’s market. Whether you should buy a home largely depends on your personal situation.

The share of respondents who believe rates will go up is almost 11 times higher than the share of respondents who believe rates will decrease. However, more buyers are expecting home prices to decline within the next 12 months which negatively impacts current plans to purchase in favor of deferring plans to the future. However, it is anticipated that prices will rise at a slower rate than they did in 2021.

Should I refinance my mortgage now?

A cash-out refinances allows you to replace your current loan with a new mortgage for more than you owe on your house, the difference is then paid to you in cash. The extra ‘cash-out’ funds can be used for things like home improvements. With a cash-out refinance, you could refinance your mortgage at a lower rate and receive a cash-out at the same time. The cash-out payment will depend on the equity you have in your home. With low mortgage rates and a squeezed inventory stoking buyer demand, housing appreciation hit never-seen-before heights in 2021. There are fewer sellers, so prospective buyers need to contend with higher housing prices.

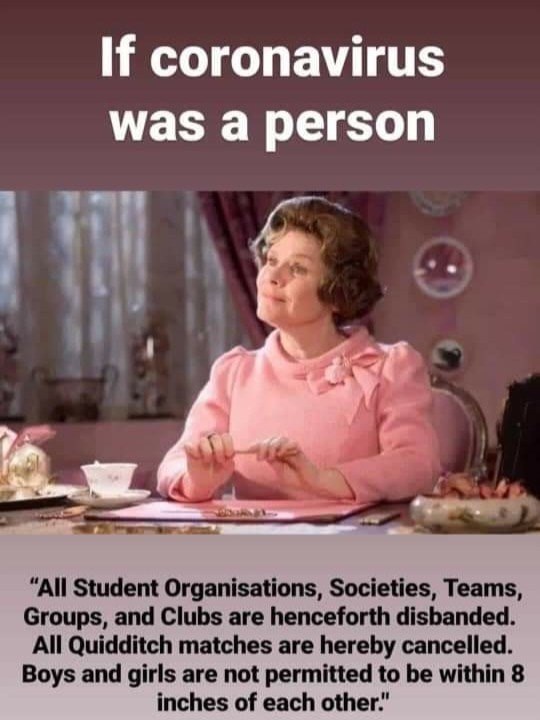

If you're in the market for a new home, buying today could mean locking in a relatively affordable mortgage rate before rates climb further. At the same time, though, it could mean paying a premium for a home, whereas waiting a few months might result in home prices coming down. Already low before the coronavirus, mortgage rates continue to decline to record lows.

Is Now a Good Time to Buy a House?

The national median price for existing homes sold in October was $379,100, according to the NAR. That was down more than 8% from June, when the median price hit a record high of $413,800. Existing homes are those that were owned and occupied before going on the market. These are some of the factors affecting buyers in today's market. We believe everyone should be able to make financial decisions with confidence.

By clicking "Sign Up" I agree to receive newsletters and promotions from Money and its partners. I agree to Money's Terms of Use and Privacy Notice and consent to the processing of my personal information. By clicking "TRY IT", I agree to receive newsletters and promotions from Money and its partners. Money's Top Picks Best Credit Cards Cash back or travel rewards, we have a credit card that's right for you. First Time Homebuyer's Challenge Fast-track your home purchase with this Money challenge.

What’s Different About Buying a House in 2021

Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 0.7 percent, and the Conforming MCAI fell by 1.2 percent. The message could signal a smaller rate hike in December but during the press conference Chair Powell also noted the ultimate level of interest rates will be higher than previously expected. The Fed aims to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2%, which remains elevated around 40-year highs. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. For instance, if you get your initial mortgage approval soon, you can lock in interest rates before they go any higher.

The discount program applies to single-family homes — including condos and townhomes — and 2-4 unit properties. Under the new FHFA plan, home buyers get mortgage rate discounts of as much as 1.75 percentage points off standard market rates. According to Freddie Mac, 30-year fixed-rate mortgage rates peaked in November, then dropped 0.59 percentage points to reach 6.49 percent nationwide, on average. Due to higher prices and interest rates, the mortgage payment on an average home is now nearly $800 more than just before the pandemic began. In October, the inventory of homes that are actively listed for sale continued to grow and caught up to 2020 levels.

These days, there are a couple reasons why your mortgage approval is more likely to fall through. The first is that it’s not unusual for banks to verify your employment more than once during the mortgage-approval process, whereas before they may have only done it once. Our lender called my accountant the day before our closing date to verify — for the third time — that my business was in good standing. With high unemployment levels, job losses are to be expected and banks aren’t taking any risks.

Experts believe many home buyers originally intended to buy this spring but then the COVID-19 measures thwarted those plans. They expect a release of this pent-up demand when the economy begins to re-open. And of course, when you pay rent, you ultimately pay off your landlord's mortgage.

Listing price growth remained within the double-digits but continued to moderate. Jamie Johnson is a Kansas City-based freelance writer who writes about a variety of personal finance topics, including loans, building credit, and paying down debt. If nothing else, it’s a good idea to do your research and look into it. After crunching the numbers, you may find that your mortgage payments would cost less than you’re currently paying in rent.

No comments:

Post a Comment